I wrote this a day after Microsoft released its annual figures for 2008. But somehow haven’t found time to actually post it.

Until today.

For, today was a day that I will never forget. Today was a bitch.

We have all been talking about the market slowdown, the global meltdown and all that, but today was the day that reality came up-close to my face – and planted a slap on it.

It happened as I was walking out of office, I saw her moist eyes. The eyes were red, but seemed determined to be composed, and yet the tears just wouldn’t cooperate.

For, earlier this morning, she had walked in to work with a song on her lips and enthusiasm in her heart. And in the evening she was clutching a pink slip, had to hand in her id card and was escorted out of the campus, never to return.

Yes, she was a poor performer who had been given the pink slip. Someone who might have got a moderate increment for the same performance a few years back.

Quite an unsettling episode if you ask me.

But its really is not a case against the employer. It is all about the market – and that’s what I wrote about in the post I mentioned. Lets get right to that post now…

_____________________________________________________________________________________

Product companies may come and grow, but no other company has been as representative of the software era as Microsoft has. Microsoft has been that Czar that everyone from media to industry to entertainment has looked up to.

For a validation, if you will, of any sort – trends, predictions, assessments and statements on technology evolution, immigration laws, IT acts, infrastructure, economic issues, Microsoft’s interpretation and view has been a great influence in setting world perceptions.

But now, the markets are changing.

Over the last few quarters, we have seen huge banks crumbling practically overnight. We saw juggernaut auto makers come to the brink of bankruptcy. We saw ripples of such economic effect spreading across to other world economies.

And now when you learn that the economic slowdown has resulted in affecting the behemoth itself, you have to sit up and start chewing your nails.

Here is what Steve Balmer said to his employees –

“Our financial position is solid … but it is also clear that we are not immune to the effects of the economy, Consumers and businesses have reined in spending, which is affecting PC shipments and IT expenditures.”

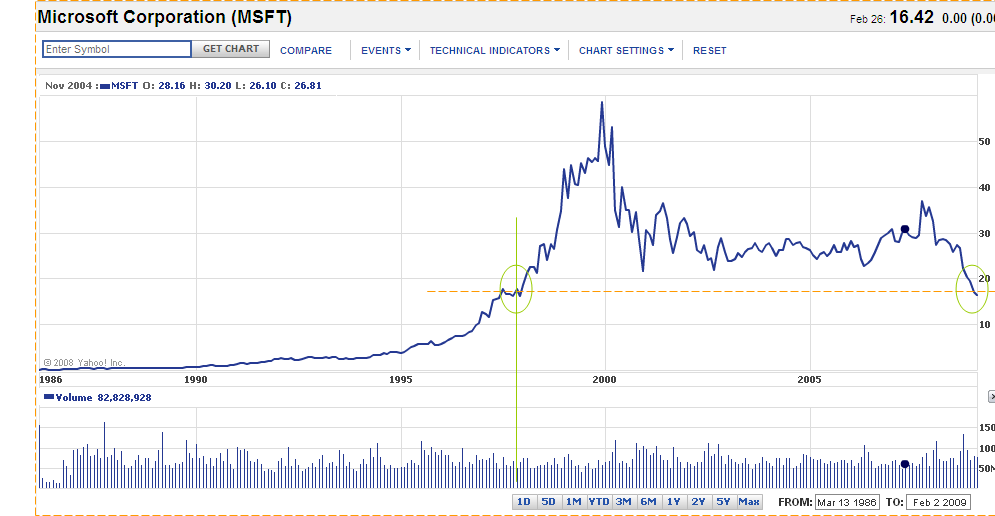

Click to see a bigger image. Source: Yahoo Finance(click)

Microsoft’s results have been disappointing to say the least.

In its Q2 results ending Dec 31st, Microsoft posted a profit of $4.17 billion, or 47 cents per share, This pales in comparison to a profit of $4.71 billion, or 50 cents per share, last year.

It is no joke that this is the lowest in a decade. But that’s not really the worst you’ve heard. Microsoft plans to cut about 5000 jobs over the next 18 months, of which about 1400 jobs are to go immediately.

That’s something that has sent ‘shock waves’ into the industry.

This is the company that is one of the biggest beneficiaries of H1 Visas. This is the American company that joins Indian service providers in appealing to the American government for bigger quotas for skilled immigrant workers.

Well just like no one is above the law, it just shows no one is above market forces either.

This slowdown sucks.

It seems determined to eradicate some of our most cherished symbols of enterprise – indeed some very icons of mans evolution itself.

It is unfortunate that you are exposed to the IT industry more than other manufacturing industries. At the macro level, it is not too bad for India compared to other countries. Let me quote from a recent analysis by The Foreign Policy Research Institute

E-Notes

Distributed Exclusively via Fax & Email

ASIA’S ECONOMY:

CHALLENGE AND OPPORTUNITY FOR THE OBAMA ADMINISTRATION

by Terry Cooke

February 27, 2009

“India, which was even later than China to plug back into the

global grid following its failed experiment with socialism,

is now enjoying some of the benefits this relative

insulation has conferred in the current crisis.

Additionally–and uncharacteristically for Asian economies–

it has a relatively highly developed service economy, which

lessens its economy’s weighting toward manufactured exports.

Due to these and other factors, India appears positioned to

withstand the financial turbulence in 2009 with its growth

momentum reasonably intact. Having registered approximately

8 percent growth in 2008, it appears on track to achieve

close to 6 percent growth in 2009.”

Incidentally, 6% growth, though lower than earlier growths that we have seen, is not something to sneeze at. West could not grow at more than 2 to 3% the past decade and a half or so!

Absolutely – Our experiments with Socialism and resulting regime of protectionist policies somehow seem to have worked in our favor in the current state of world economy – at least so far. India seems to have adopted economic policies that, to borrow a quotable quote from you, seem wise in hindsight.

I was at Big Bazaar and a few other electronics showrooms here in Mumbai in the last few days and I see absolutely no sign of any anxiety or restraint among shoppers.

Having said that, the IT boom has significantly boosted the purchasing power of the ‘burgeoning’ Indian middle class. The top ten India based IT companies including Infosys, Wipro, Satyam, TCS provide employment to around 500,000 Indians – and if you include the BPOs- the call centres etc, we are talking about roughly 700,000 employees. With a huge disposable income, this segment has had a significant influence in the boom we saw in the Real Estate markets, banking and financial services, automobile sales, retail sales and so on.

The kind of impact this slowdown is going to have will likely become apparent in the next few months when IT companies that depend on US business (to up to 60%) complete their appraisal cycles – I would hazard a guess that on average, each company would lay-off around 10% of their employee force. We are talking about close to 50,000 to 70,000 jobs being lost.

While the global slowdown may be attributed to specific macro economic flaws, I sometimes think it may also be fanned also by a worldwide wave of irrational hysteria and over-reaction.

I wish I had slipped into bollywood as a script writer! Or stated an Udipi restaurant.

If the IT industry has got any sense, they would heed what Nandan Nilekani says in his wonderful book. This is the time to go after massive computerization of the Indian businesses. People like you should go after small and medium businesses to get them to put in ERP. By the time West gets back on it feet, our industry will be able to take them on more efficiently and also be cost effective. The present situation presents an opportunity.Perhaps some of the laid off people can become entrepreneurs. I wish that I was thirty years younger!